I was just reading in one of my favorite blogs, GigaOm, about documents unearthed because of Goldman Sachs’ investment in Facebook. Though the Facebook seems to have generated about $77 million in net income this year, it could generate as much as $1B in profits next year.

I was just reading in one of my favorite blogs, GigaOm, about documents unearthed because of Goldman Sachs’ investment in Facebook. Though the Facebook seems to have generated about $77 million in net income this year, it could generate as much as $1B in profits next year.

TechCrunch even published a table showing their different revenue line items. I was actually surprised by the $75M run rate for virtual goods that, although substantial, was lower than I had thought it would be. It’s interesting to note, also, that while Facebook stays private, Linkedin is rumored to soon go public.

There’s an interesting quote at the end of the GigaOm article from a Piper Jaffray analyst stating that Facebook continues to take advertising revenue away from Google. There’s definitely a lot of conjecture about what Google should be doing in regards to social media. One of their own VPs actually made a statement to the effect that they’re letting Facebook take over that space. Talking more about Google, I found a recent article by David Linthicum quite interesting. In that article, he talks about why Google should acquire Amazon!

Finally, it’s not only about Facebook, other sites like Quora and Groupon are growing rapidly thanks to their social component. Many ask if Google has ceded this space to Facebook and others or whether their GoogleMe product might better position them in this space. What do you think? Will “social” increase or decrease Google’s relevance over time or is that the wrong question to ask?

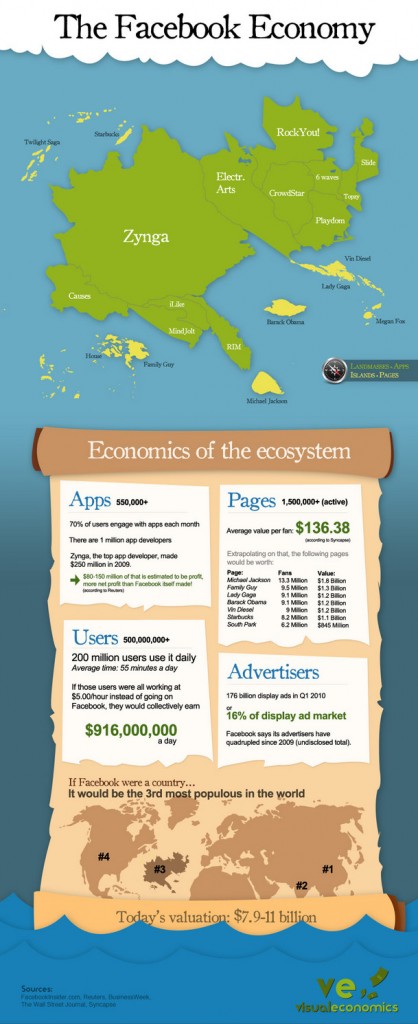

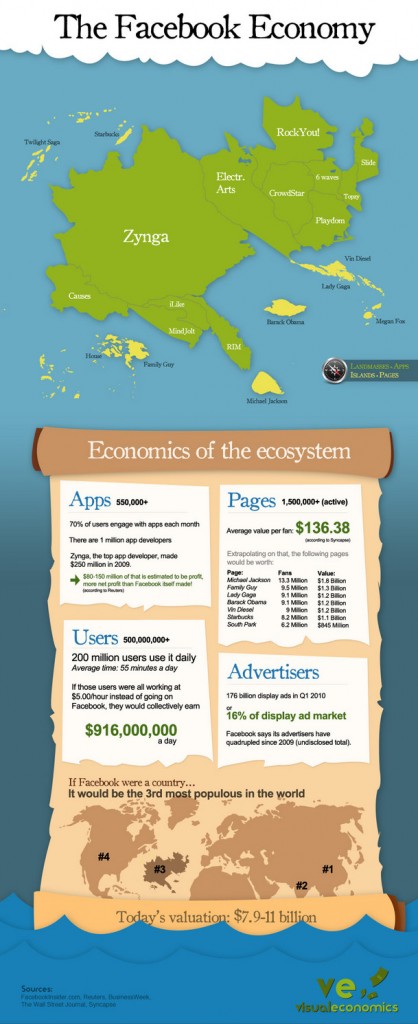

Below is a larger version of the Facebook Economy Infographic from VisualEconomics:

According to research from TeleGeography, Skype added twice as many long distance minutes than all of the other long distance providers combined! Although long distance is now only a small part of telecommunications company revenues, Skype keeps on innovating by coming out with video chat for mobile and TV. GigaOm analysts feel that video calls and video chat will make up 30 billion calls by 2015.

According to research from TeleGeography, Skype added twice as many long distance minutes than all of the other long distance providers combined! Although long distance is now only a small part of telecommunications company revenues, Skype keeps on innovating by coming out with video chat for mobile and TV. GigaOm analysts feel that video calls and video chat will make up 30 billion calls by 2015.